NAPCO Research and Promo Marketing recently released the fourth iteration of their ongoing Promotional Products Industry Recovery Research (Vol. 2, No. 1), which aims to track how the promotional products industry is reemerging from issues faced during the COVID-19 crisis.

Download the full report here or read on for three key takeaways from the research.

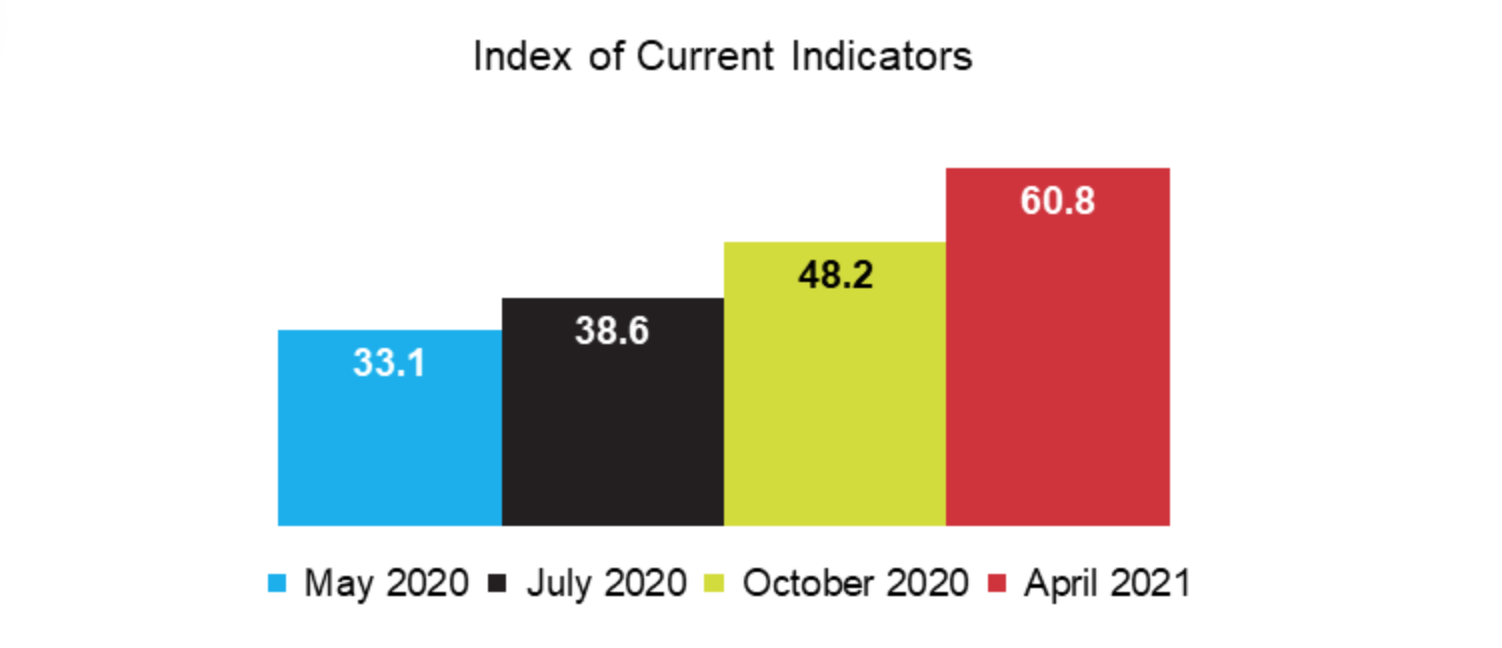

1. Index of current indicators shows growth for the first time since the research began

According to the latest current indicators reading, business activity throughout the industry is rising. The index tracks sales, pre-tax profitability, employment and prices. A reading above 50 indicates business activity is rising, while a reading below 50 indicates the opposite. Following the first quarter of 2021, the index reached 60.8. The highest seen thus far and up significantly from the reading of 48.2 in October 2020.

This rise was driven mainly by respondents indicating increases in sales and prices across the industry. These indicator values read at 62.0% and 52.8% respectively. For the first time, more companies are also reporting employment increases than decreases, as 14.8% of respondents said that their employment numbers were trending upward, while only 12.0% said they were trending downward. The only reading that didn’t represent growth came from pre-tax profitability, in which 29.6% of respondents said that profitability was rising while 33.3% said that it was trending downward.

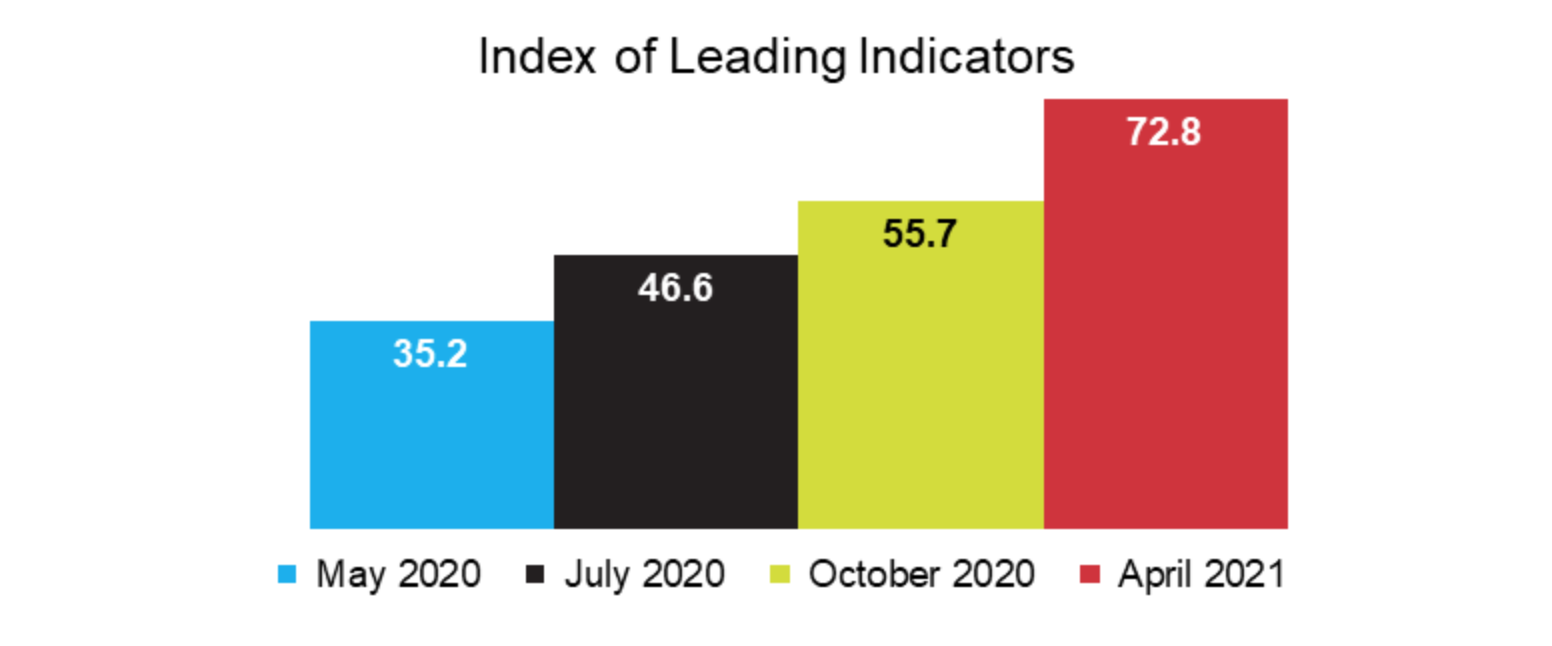

2. The index of leading indicators points to even more growth in the near future

The Promotional Products Industry Recovery Research also tracks a few leading indicators that typically translate to growth when they are trending upward: quote activity, new orders and confidence. A reading above 50 for these tell us that business activity will be rising while a reading below tells us the opposite.

In the previous iteration of the research, the index of leading indicators topped 50 for the first time, at 55.7. We can see how this translated to growth as the following current indicator reading reacted by cracking 50.

In the most recent release, the index of leading indicators rose yet again—to 72.8. This rise was driven by all three of the indicators, as 63.9% of respondents are more confident about the business environment, 61.1% see rising trends in quote activity and 56.5% report an increase in new orders. Once again, this will likely translate to a higher index of current indicators in the next quarter.

3. Respondents highlighted the biggest challenges faced throughout the pandemic

We asked respondents to report the greatest challenges they faced throughout the recession and although we are clearly moving away from COVID-related issues, some of these challenges will continue to linger. About three quarters (74.1%) of respondents indicated that they faced the following three challenges:

- Decrease in demand for products/services

- Supply disruptions/difficulty obtaining materials, consumables, substrates, etc.

- Shipping issues (rising costs, delivery delays, etc.)

While there is evidence in the research that demand issue should seize somewhat, the other two previously mentioned challenges will be longer lasting as shipping costs continue to rise and many supply chains have not been fully repaired quite yet.

Most of the other challenges mentioned will likely go away, such as government shutdown of clients (50.9%) and constant uncertainty (67.6%), but other, lesser indicated issues may become more prevalent as time goes on. Only 26.9% indicated that they were facing increases in consumable prices, while 22.2% indicated and increase in substrate prices.

As inflation takes hold and prices go up, promotional product companies must decide how they will deal with these increases. They will have to pass along the price increases to the customer, absorb the extra costs and reduce profit margins or increase productivity and efficiency to offset the increases. Likely, most companies will have to implement some combination of all three. Each company will have unique circumstances and will have to develop their own plan of action moving forward.

The final challenge that will still have to be dealt with moving forward is employee shortages. While only 19.4% of respondents faced this issue during the pandemic, employee shortages have been hurting many industries throughout the recovery period. Finding qualified and experienced employees is becoming increasingly difficult, so recruiting and retention capabilities will be integral moving forward.

Participate in the Promotional Products Industry Recovery Research:

In today’s unprecedented business environment, making decisions based on facts has never been more important. In the weeks and months ahead, reliable industry business indicators will be essential for monitoring what’s happening in all industry segments. The Promotional Products Industry Recovery Research is an essential resource for monitoring industry conditions, and the NAPCO Research and Promo Marketing teams invite you to join our business panel and contribute to the research on an ongoing basis. Companies that join the panel will receive an exclusive version of the report that includes additional data and analysis. To join the COVID-19 research panel, please click here.

About NAPCO Research:

NAPCO Research develops research and economic models that solve customer business problems. Market research is valuable for making strategic business decisions, solving challenges, and pursuing opportunities, and the NAPCO Media research team surveys, analyzes, and monitors critical trends related to marketing, printing, packaging, nonprofit organizations, promotional products, and retailing. To learn more about how the team can leverage its research and industry subject matter experts to support your organizations needs contact NAPCO’s vice president of research, Nathan Safran, at [email protected].